In an era defined by technological leaps, companies must innovate or be left behind. Venture Client approach offers a lifeline.

In the fast-paced industrial landscape fueled by rapid technological advancements, large companies have embraced various corporate venturing methods to stay competitive. These methods, such as Corporate Venture Capital (CVC) investments, internal Venture Building initiatives, and commercial Venture Client partnerships, aim to expedite corporate product innovation and growth amid a complex landscape of emerging technologies and business models.

These diverse corporate venturing approaches offer access to cutting-edge advancements but also provide strategic alignment with long-term objectives, fostering a culture of innovation and agility essential for staying ahead in today’s dynamic market environment. It is important to understand that these are unique approaches, each with its own strategic objectives, strengths, and weaknesses in different circumstances. Therefore, finding the right approach for corporate needs is crucial.

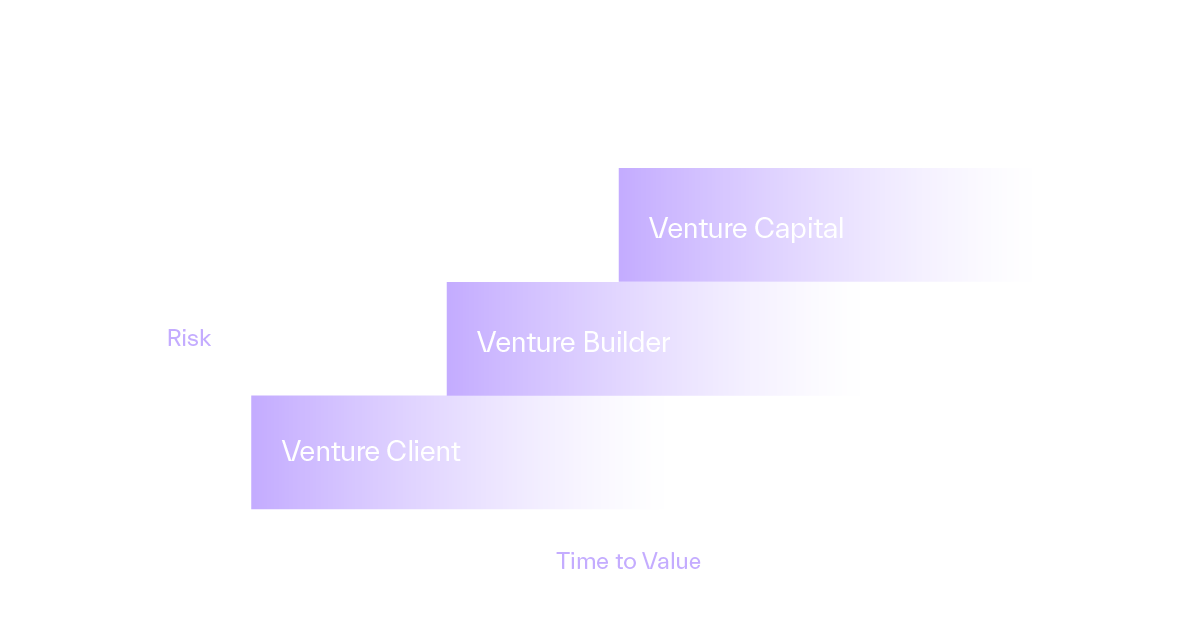

Comparing the three different venturing approaches

- One prevalent approach is Corporate Venture Capital (CVC), where corporations strategically invest in existing startups. This investment provides financial capital to startups and strategic mentorship, aiming to align the startup’s growth with the corporation’s long-term objectives. However, it is important to note that this approach may entail high capital requirements and does not always offer the possibility of seamlessly integrating the solution – especially in the short term.

- Another common approach is Venture Building, also known as Incubation. In this model, corporations internally develop their own startups, nurturing them from concept to market launch. This method enables corporations to closely guide the development process, ensuring that the new venture aligns with their strategic goals and market vision. However, balancing various goals within the company and accepting different time- and risk horizons might pose challenges.

- Lastly, corporations are increasingly engaging in commercial partnerships with startups as Venture Clients. This approach involves large companies becoming customers of startups, purchasing their products or solutions while co-developing them further to meet specific corporate needs. This provides startups with crucial revenue, customer feedback, and reputable reference clients, while corporations can acquire a strategic benefit by directly adopting cutting-edge solutions and technologies. Combining high compatibility with corporate needs alongside a substantial market availability of solutions, this relatively lightweight and well-tested approach allows both sides to foster mutually beneficial relationships through controlled and stepwise collaboration.

The time horizon and risk profiles of different corporate venturing approaches are pivotal in shaping the outcomes and success. By understanding these differences, corporations can strategically navigate the corporate venturing landscape, selecting the appropriate vehicle for their innovation needs in alignment with their overarching strategy, innovation horizon, and risk appetite.

The Venture Client approach stands out for its significantly shorter Time to Value and less capital requirements, as corporations can immediately leverage startups’ innovations with rapid experimentation and a quick feedback loop in real-world conditions. This comes without the need for hefty investments in in-house capabilities or complex equity-based relationships. This rapid testing and integration of solutions enhance value creation and scalability, contrasting with the longer Time to Value and risks associated with Corporate Venture Capital and Venture Building.

Furthermore, the Venture Client approach provides a lower risk profile, as corporations engage directly with startups to address specific needs, thus mitigating the risk of investing in unproven technologies or business models.

The Versatile Advantages of Venture Client Model

Commercial startup partnering offers numerous benefits for corporations looking to stay ahead in their industries:

- Accelerated Innovation: Expedite time-to-market for R&D and business development across digital and material innovation.

- Enhanced Agility: Quickly address pressing needs by leveraging the inherent agility of startups where internal capabilities are lacking.

- Operational Excellence: Drive efficiency in supply chain, quality, and cost management.

- Access to Cutting-Edge Technologies: Tap into leading startup networks to access globally leading technology growth companies.

- Talent Acquisition: Engage with highly ambitious and innovative startup teams, inspiring the organization to innovate.

- Broadened Perspectives: Gain valuable insights and novel approaches from top startups and growth companies.

- Flexibility and Low Capital Requirements: Gradually test compatibility and deepen startup collaborations in a non-binding manner, conducting first swift and cost-efficient proof of concepts with a quick feedback loop and substantial knowledge gains.

- Free Rider Advantage: Leverage startups’ R&D efforts without direct investment, adopting specific solutions or technologies with reduced risks.

The Proven Efficiency of Venture Client Model

Research shows that the Venture Client approach is the most efficient corporate venturing mechanism. Compared to other methods, the Venture Client model offers the lowest capital requirements and the highest speed. According to a study by IESE with 120+ corporations, Venture Client approach is seen as 50% faster and 3x more cost-efficient than corporate accelerators.

In today’s rapidly changing business environment, agility and adaptability are key to success. Venture Client model provides corporations with a nimble, cost-effective approach to innovation, allowing them to respond quickly to market changes, leverage cutting-edge technologies, and drive operational excellence. By partnering with startups as Venture Clients, corporations can unlock new growth opportunities, drive meaningful change, and shape the future of their industries.

As a Venture Alliance, Combient Foundry stands ready to facilitate these transformative partnerships, connecting corporations with the most innovative startups globally, while driving industrial innovation initiatives at scale. For more information, please visit our website: https://combientfoundry.com/